2022 FinTech M&A Roundup: Economic Climate Driving Industry Consolidation

January 6, 2023

2022 FinTech M&A Roundup: Economic Climate Driving Industry Consolidation

2022 has been a year of two contrasting halves in the FinTech world. The first quarter of 2022, carrying the momentum from 2021, started with a bang with several Digital Banking and Digital Payments firms raising 100M+ funding rounds with eye-popping valuations. Since Q1 2022, FinTech valuations in both private and public markets have suffered a swift and massive correction over the last three quarters of 2022.

Complimentary Research

Description

The FinTech industry has experienced a period of consolidation in 2022 due to the current economic climate, characterized by a slowdown and the prospect of a recession. This has led fintechs to seek mergers or acquisitions with other firms in order to unlock economies of scale and scope, as well as gain access to additional capital and other resources.

Consolidation is also being driven by the need for financial institutions to innovate and stay ahead of the curve by acquiring innovative fintechs and their tech capabilities and business expertise.

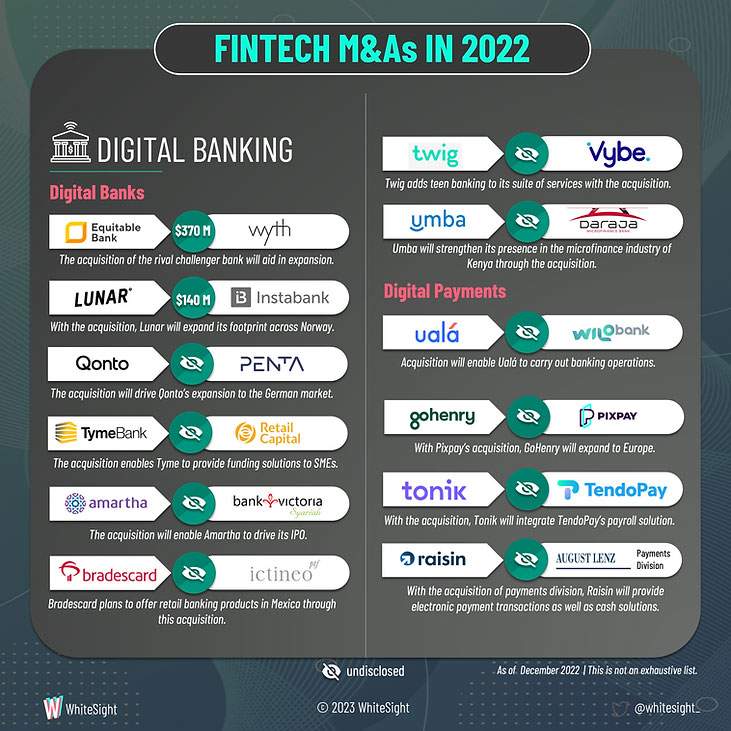

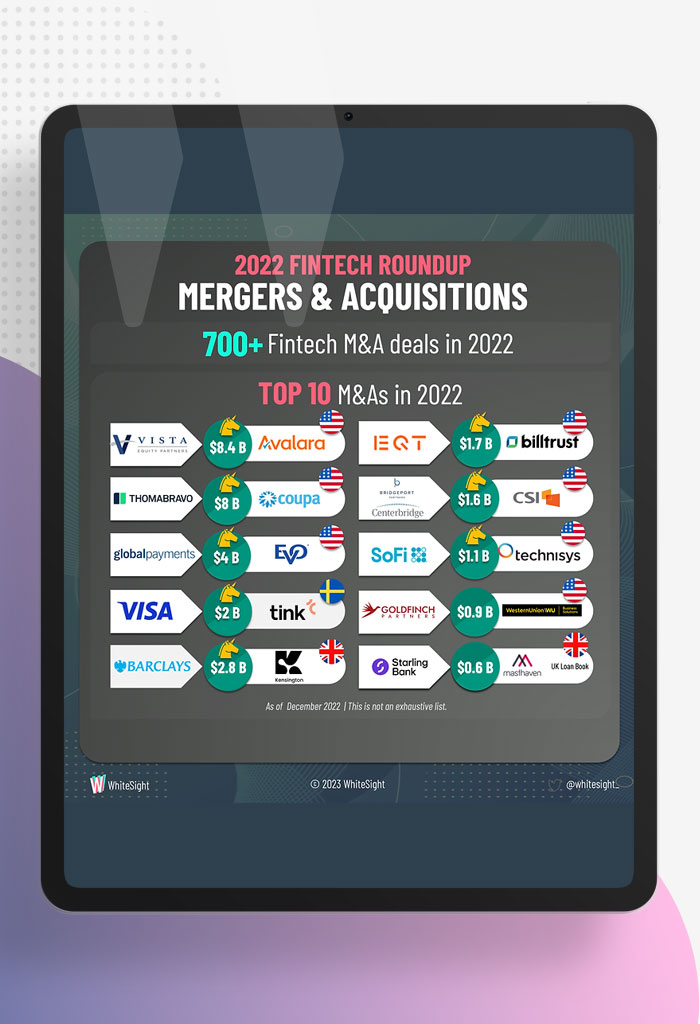

FinTech Mergers and Acquisitions Roundup 2022 provides a summary of notable M&As across the segments of digital banking, digital payments, FinTech infrastructure, embedded finance, and more.

Already a subscriber? Log in to Access

Radar Subscription Plan

Radar Subscription PlanYour perfect fintech research companion – select a package that aligns with your aspiration

Not Ready to Subscribe?

Begin your fintech adventure free of charge-set forth with our complimentary offering.

Related Reports

Monzo went from challenger bank to a £1.2B-revenue machine, without losing its inimitable Hot Coral halo. What actually…

From disrupting cross-border money movement to building a 60M+ customer base across 48 countries, Revolut has consistently stretched…

WhiteSight joins forces with Toqio to explore the evolving B2B Embedded Finance landscape, unpacking how corporates can turn…

BNPL shifted deeper into retail and banking infrastructure, while tokenisation gained serious ground in real estate and assets….

CBDC pilots ramped up in India, Korea, and Thailand. Regulators rolled out clearer digital asset rules. And across…

Latin America’s fintech pulse beat louder in Q1 2025. From cross-border scale-ups to QR-powered payments and licensing-led land…

Nubank’s building a case as the most dominant fintech on the planet. With 114M+ users, $2B+ in net…

From BNPL baked into payment rails to co-branded cards reshaping loyalty—Q1 2025 was a turning point for embedded…

From credit cards in developing markets to crypto custody for institutions, Q1 2025 saw digital banks get serious…

As 2025 kicks off, embedded and digital finance continue to deepen their foothold across industries. Embedded finance saw…

Q4 2024 marked a defining period in digital finance, characterized by regulatory greenlights fueling global digital bank expansions…

The embedded finance landscape in 2024 has been shaped by deeper industry verticalization, cross-border scalability, and strategic consolidation….