Black History Month: A Moment To Celebrate Black Voices Driving Inclusion Initiatives

- Sanjeev Kumar and Kshitija Kaur

- 4 mins read

- Insights, Sustainable Finance

Table of Contents

Black History Month: A Moment To Celebrate Black Voices Driving Inclusion Initiatives“Our lives begin to end the day we become silent about things that matter” – Martin Luther King Jr.A lack of inclusion and representation for Black communities exists at every level of the financial system in the US, UK and other developed markets. The FinTech phenomenon, which started with the agenda to address this as one of the core issues, seemed to have managed to move the needle, but we are still a long way from achieving the equitable access of financial services across different communities.Establishing a sound financial ecosystem—for oneself as well as for the varied communities we flourish together in—results in ensuring this altruistic and essential goal of growth is sustained in the experience of humankind. When people from all walks of life bring diverse perspectives in the financial system, they contribute in fabricating the many delicate threads that form the blanket of economic prosperity. The empowerment that comes from the ability to assemble a business, access micro-financing strategies through informed decisions, and better handle the natural ambiguities of ‘financial shocks’ provide the grounding emotional charge of a better outlook of self, and the world in general.This […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

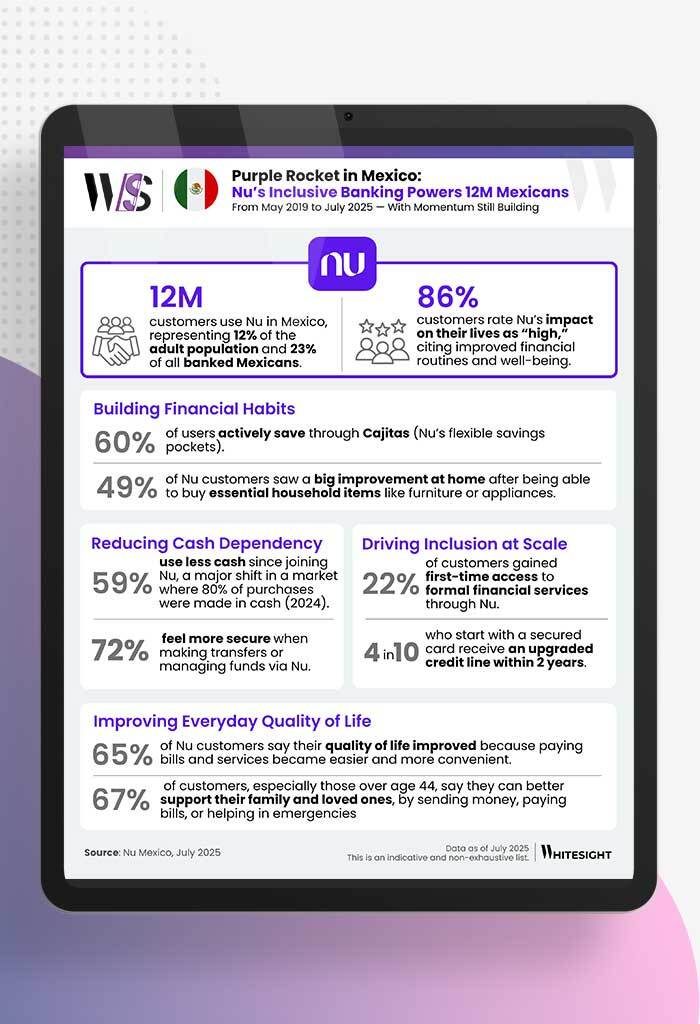

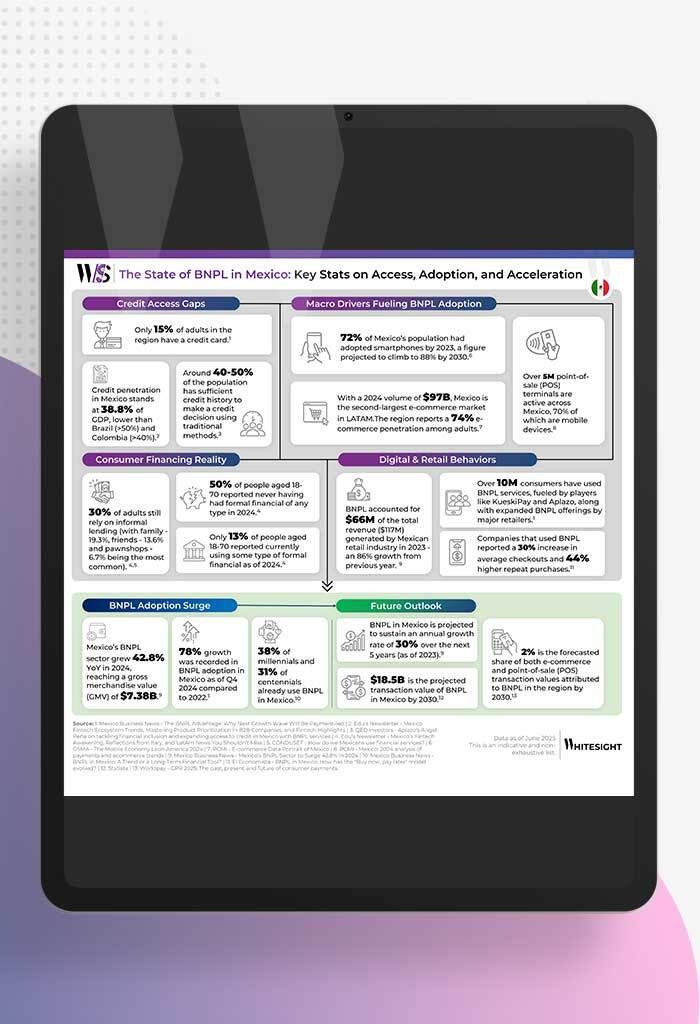

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar