Facing The “Reality”: Facebook’s Meta Move

- Sanjeev Kumar and Risav Chakraborty

- 5 mins read

- Fintech Strategy, Insights

Table of Contents

The recent rebranding of Facebook to Meta—to emphasize the platform’s metaverse vision—has been garnering attention from all sectors alike. However, the platform is no stranger to scrutiny. Ever since its genesis in 2004 by 19 year old Harvard sophomore Mark Zuckerberg, controversies, allegations and lawsuits have been the constant companions for Meta. But that hasn’t deterred the tech behemoth from being one of the most valuable companies in the world by market value. Diversification has always been a pivotal aspect in the tech giant’s innovation strategy, and it has held a long standing ambition to add payment services to its portfolio. One of Meta’s earliest attempts to foray into the finance industry can be traced back to its partnership with American Express in 2016, where it provided the bank’s card holders with an AmEx bot in the Messenger app. In this post, we explore some of the key events that shaped Meta’s journey in its quest to disrupt the payments industry. Paying Heed To Payments Meta’s courtship with payments can be dated back to 2016 – when it unveiled a feature where Messenger bots can accept payments natively without redirecting users to external sites. The launch of the marketplace feature […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Kshitija Kaur and Sanjeev Kumar

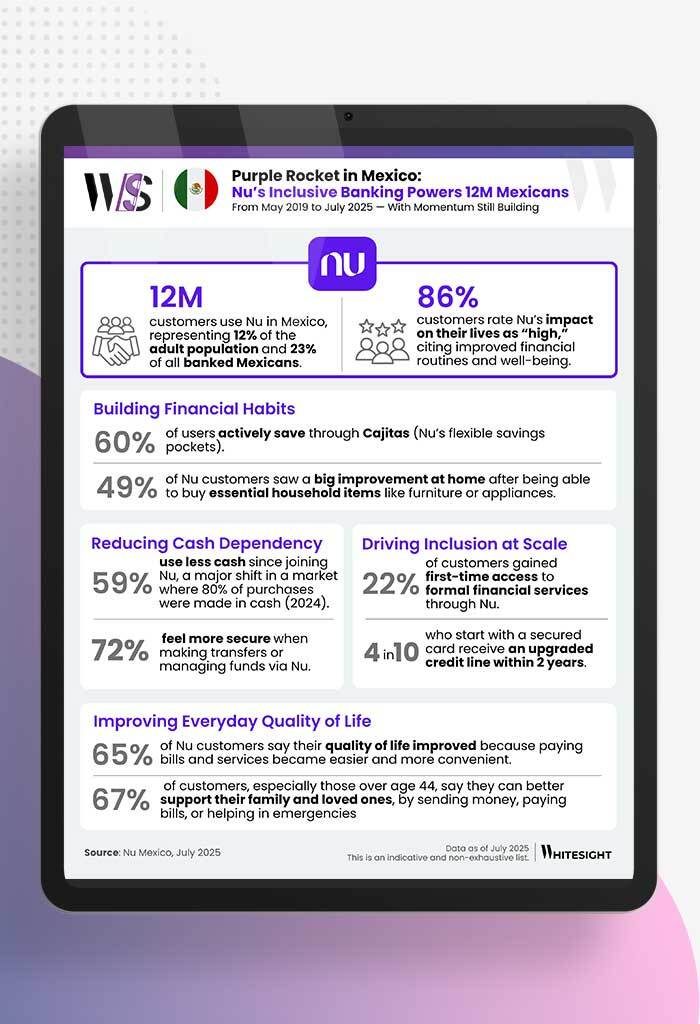

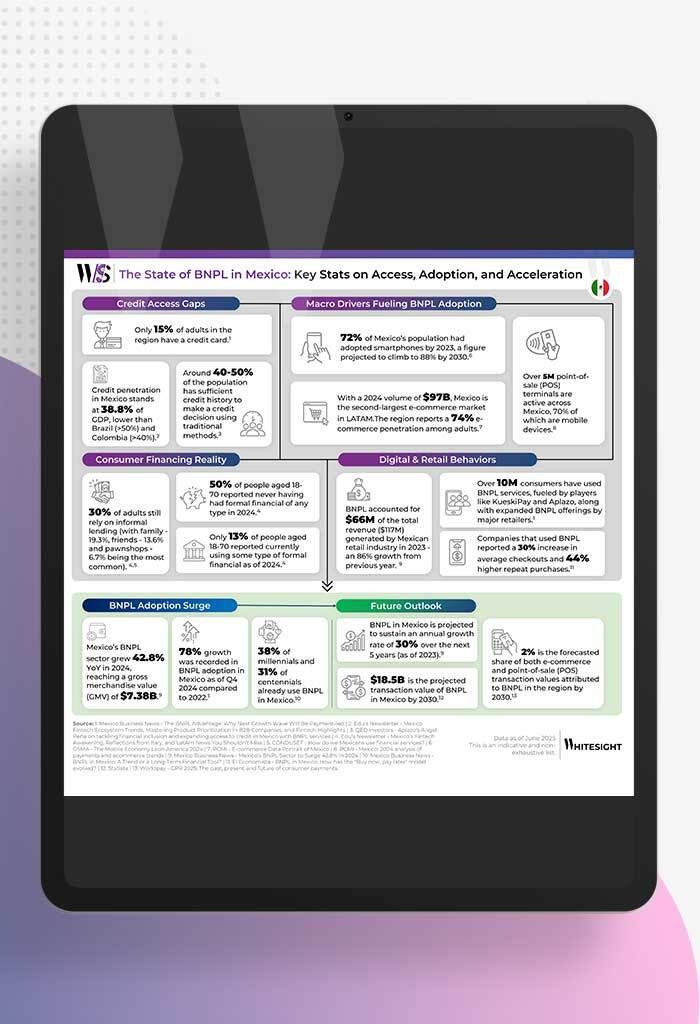

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar