Open Banking: The Dawn of Collaborative Innovation

- Team WhiteSight

- 4 mins read

- Insights, Open Finance

Table of Contents

We are delighted to partner with Spire Tech – an Aion Digital Company, to launch a global study of Open Banking ecosystem initiatives and take a predictive shot at the future course of the financial services industry transformation – enabled by the collaboration between incumbents, insurgents, enablers, and new entrants.While several incumbent banks across the globe have launched greenfield/brownfield digital banks, as a part of their digital transformation agendas to deal with the digital disruption; we feel the real impetus may come from leveraging the potential platformification opportunities that Open Banking presents.“The competition is not only between companies, it is between business ecosystems.” — Philip KotlerOpen Banking by design has put strong market incentives and regulatory nudges for banks to become modular, to focus on economies of scope and to consider creating business ecosystems as a part of their future strategy.Open Banking evolution seems to have tentacles that span from basic use-cases which are enabled by mere provisioning of banking data through APIs, to sci-fi use-cases which will require a much larger strategic alignment between banks, fintechs, and non-bank partners in terms of their business models, cultures and of course technology architectures. We formulated an evolution framework to peek into […]

This post is only available to members.

document.addEventListener('DOMContentLoaded', function() {

console.log('social login script loaded');

// Use event delegation in case buttons are dynamically rendered

document.body.addEventListener('click', function(e) {

console.log('social login button clicked');

var btn = e.target.closest('.button-social-login');

if (btn) {

// e.preventDefault();

// Disable button to prevent multiple clicks

btn.style.pointerEvents = 'none';

btn.style.opacity = '0.6';

// Change button content to 'Please wait...' with a simple spinner

btn.innerHTML = ' Please wait...';

// Add spinner animation style if not already present

if (!document.getElementById('social-login-spinner-style')) {

var style = document.createElement('style');

style.id = 'social-login-spinner-style';

style.innerHTML = '@keyframes spin {0%{transform:rotate(0deg);}100%{transform:rotate(360deg);}}';

document.head.appendChild(style);

}

}

});

});

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty

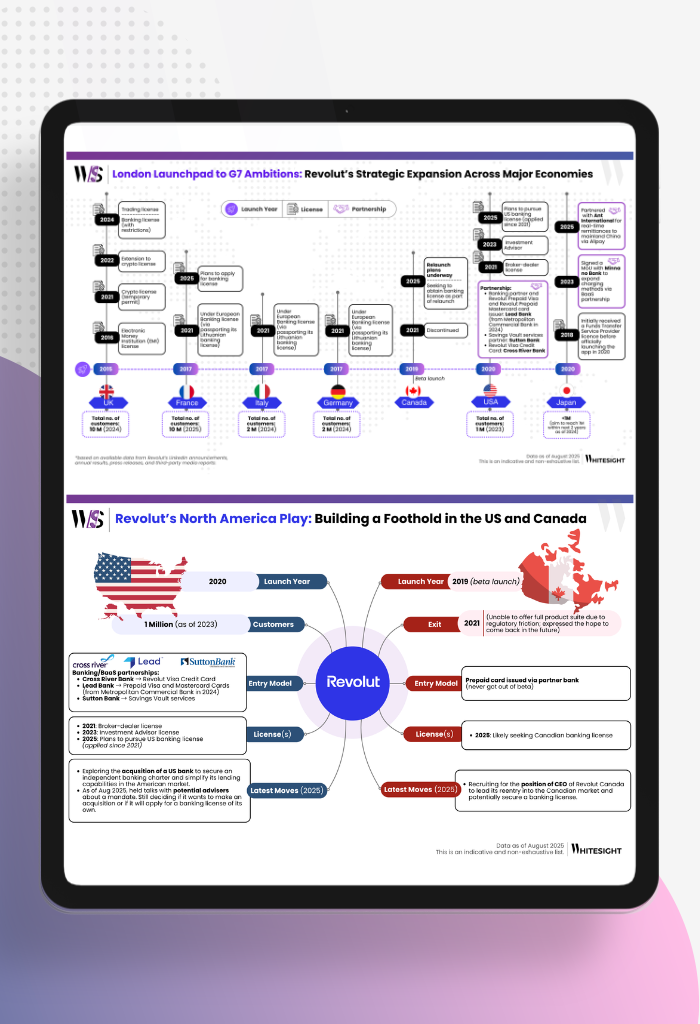

Why Revolut Is Betting on the G7 to Cement Its Global Banking Ambition The G7 nations, comprising the United States,...

- Sanjeev Kumar and Risav Chakraborty

- Sanjeev Kumar and Risav Chakraborty