Revolut | Neo-Bank Strategy Deep Dive

August 25, 2020

Revolut | Neo-Bank Strategy Deep Dive

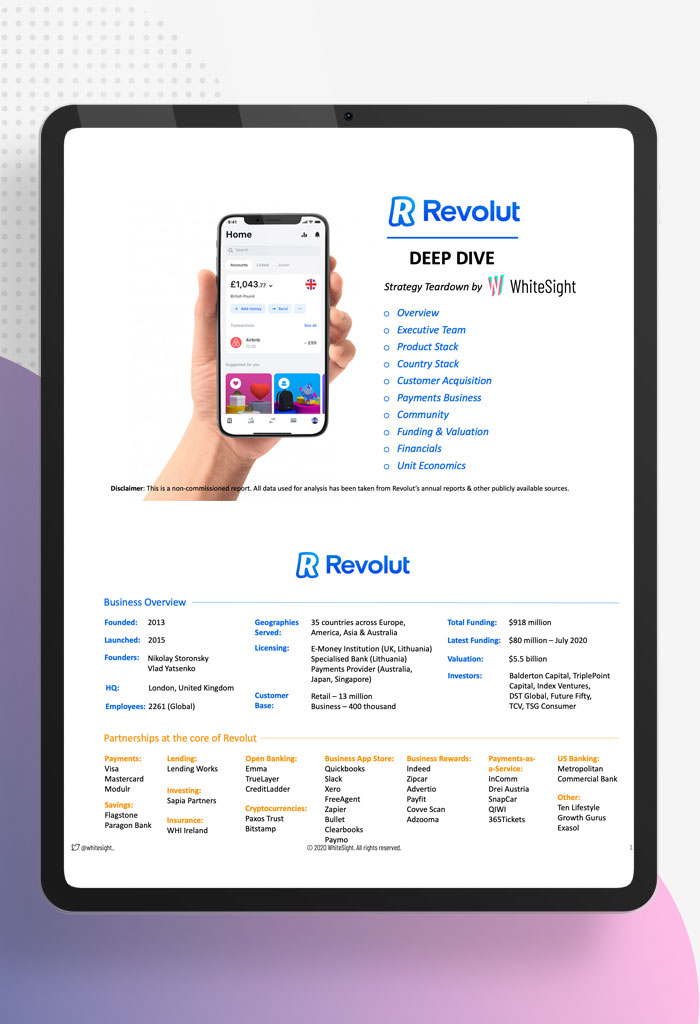

Launched in 2015 as a money transfer app, Revolut has come a long way in a short amount of time. It has significantly expanded its portfolio of products and its geographic presence and has become one of the major players in an increasingly crowded challenger bank market.

Complimentary Research

Description

Revolut: Think Big, Start Small and Scale Rapidly

This week we complete the UK Challenger Banks trifecta by covering Revolut:

Launched in 2015 as a money transfer app, Revolut has come a long way in a short amount of time. It has significantly expanded its portfolio of products and its geographic presence and has become one of the major players in an increasingly crowded challenger bank market.

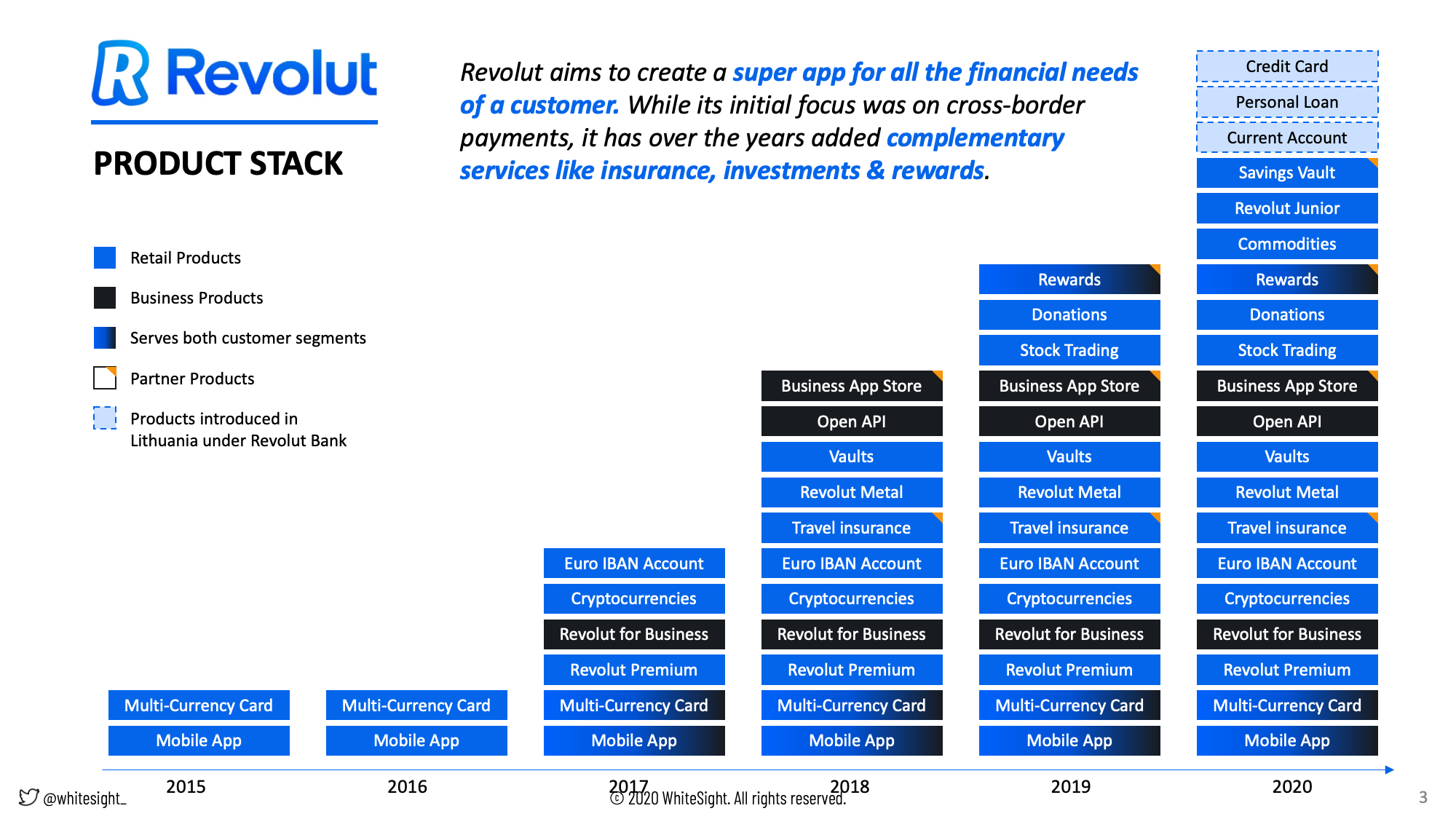

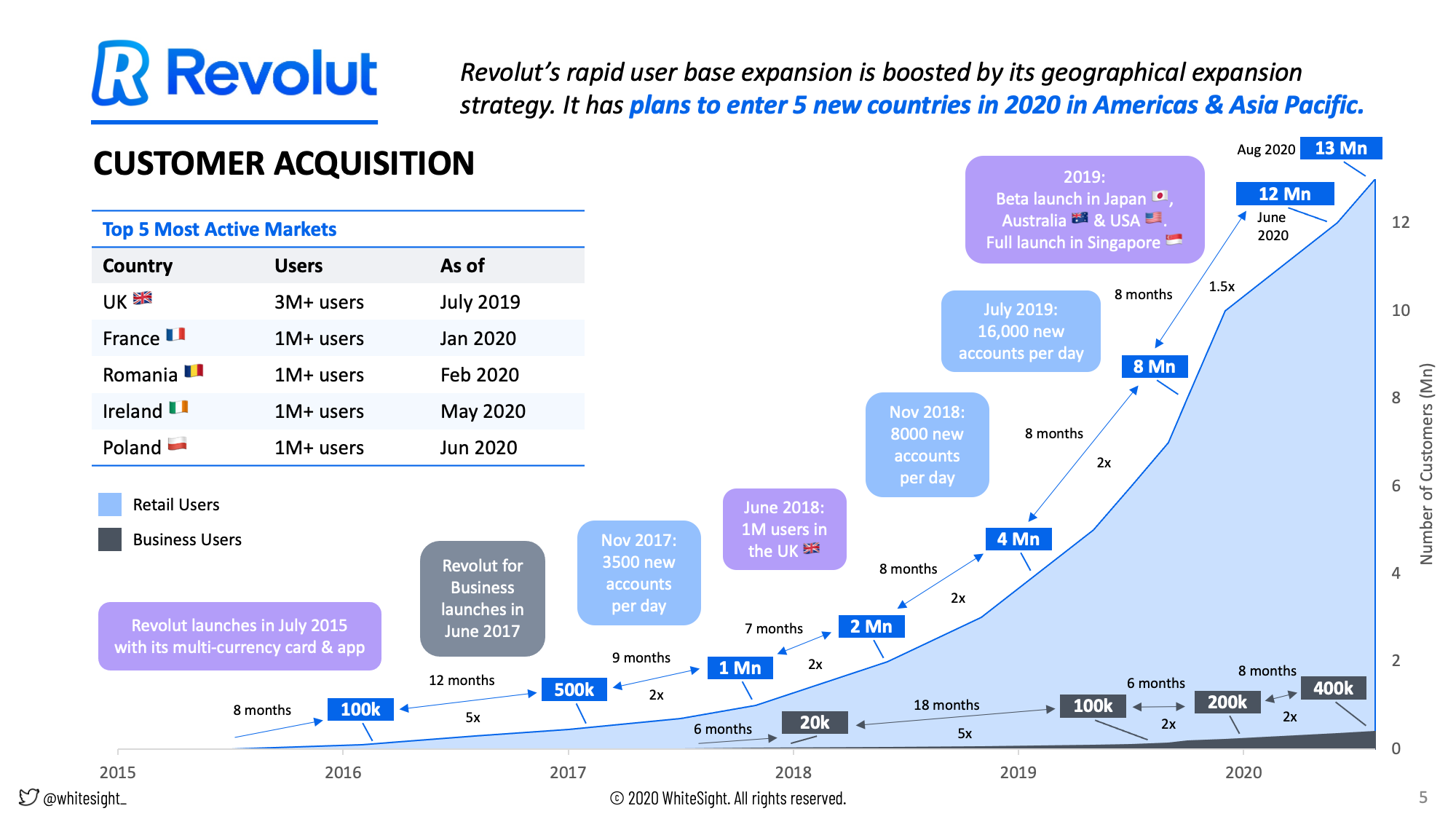

⚔️ Revolut‘s “attack vector” for rapid customer acquisition was originally low exchange fees when spending in a foreign currency, which undoubtedly fuelled much of the startup’s early growth and mindshare, but new features and products are being added at an increasingly ⏩ fast pace.

Revolut has taken a different route to banking license and mostly operates in various countries with its e-money license. This has allowed Revolut to ‘Lift and Shift’ its products and operations rather easily to multiple countries quickly and resulted in a massive customer base across 35+ countries.

Already a subscriber? Log in to Access

Radar Subscription Plan

Radar Subscription PlanYour perfect fintech research companion – select a package that aligns with your aspiration

Not Ready to Subscribe?

Begin your fintech adventure free of charge-set forth with our complimentary offering.

Related Reports

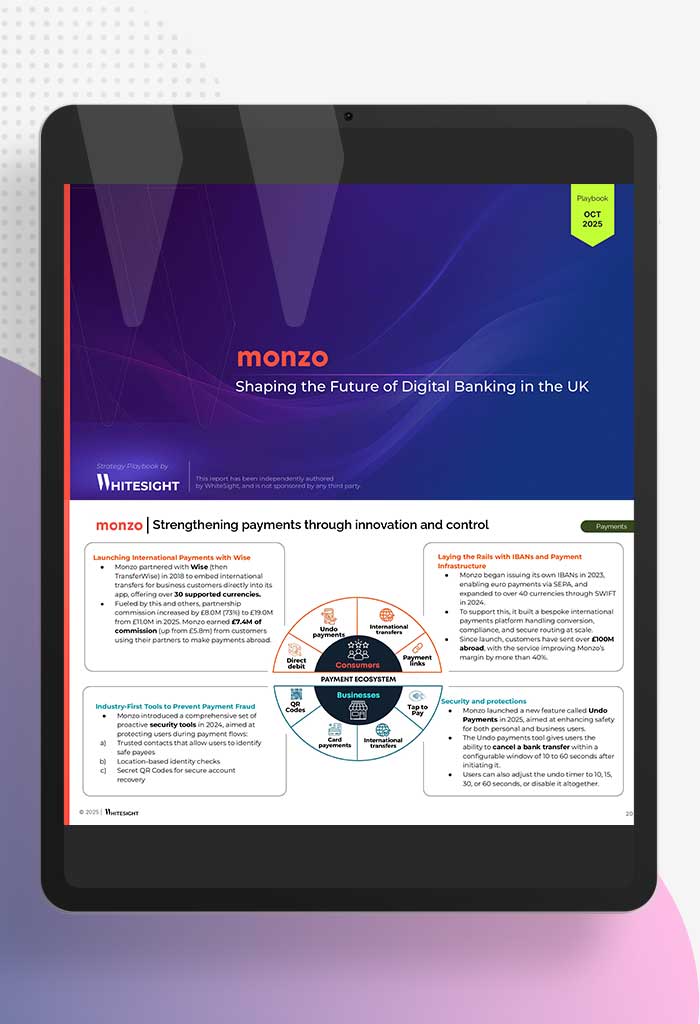

Monzo went from challenger bank to a £1.2B-revenue machine, without losing its inimitable Hot Coral halo. What actually…

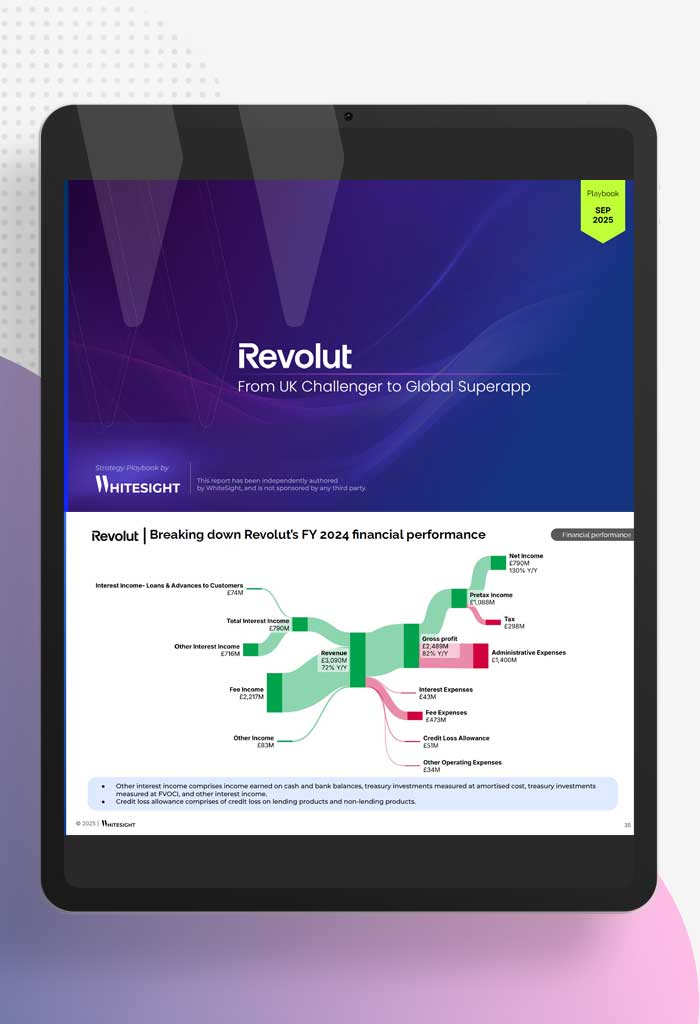

From disrupting cross-border money movement to building a 60M+ customer base across 48 countries, Revolut has consistently stretched…

WhiteSight joins forces with Toqio to explore the evolving B2B Embedded Finance landscape, unpacking how corporates can turn…

BNPL shifted deeper into retail and banking infrastructure, while tokenisation gained serious ground in real estate and assets….

CBDC pilots ramped up in India, Korea, and Thailand. Regulators rolled out clearer digital asset rules. And across…

Latin America’s fintech pulse beat louder in Q1 2025. From cross-border scale-ups to QR-powered payments and licensing-led land…

Nubank’s building a case as the most dominant fintech on the planet. With 114M+ users, $2B+ in net…

From BNPL baked into payment rails to co-branded cards reshaping loyalty—Q1 2025 was a turning point for embedded…

From credit cards in developing markets to crypto custody for institutions, Q1 2025 saw digital banks get serious…

As 2025 kicks off, embedded and digital finance continue to deepen their foothold across industries. Embedded finance saw…

Q4 2024 marked a defining period in digital finance, characterized by regulatory greenlights fueling global digital bank expansions…

The embedded finance landscape in 2024 has been shaped by deeper industry verticalization, cross-border scalability, and strategic consolidation….