A SEA of Transformation: Southeast Asia’s Digital Banking Landscape

- Kshitija Kaur and Risav Chakraborty

- 11 mins read

- Digital Finance, Insights

Table of Contents

Transformation stems from the need for innovation – to unlock novel ways of generating value. Just like the tides in a sea cause ripples of rising and falling changes through the influence of gravity, global economies experience waves of metamorphosis thanks to the impact of soaring and shifting demands from consumers and businesses in the digital era. The financial industry across the world is going through the pangs of transformation by embracing digitalisation, business model transformation, and product innovation.The financial industry transformation wave has cascaded its way to the shores of Southeast Asia (SEA) – in the form of the digital banking swell that is triggering the push for economic growth. Home to a population of more than 675 million (of which ,60% remain unbanked) and more than ,71 million micro, small and medium-sized enterprises (MSMEs), SEA is emerging as a breeding ground for digital-first business models. 100 million additional internet users have joined the digital economy in the last three years since the pandemic broke out in 2019. The current number of internet users in SEA stands at a mighty 460 million, with 20 million new users getting added in 2022 alone.This is where digital banks came in – […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

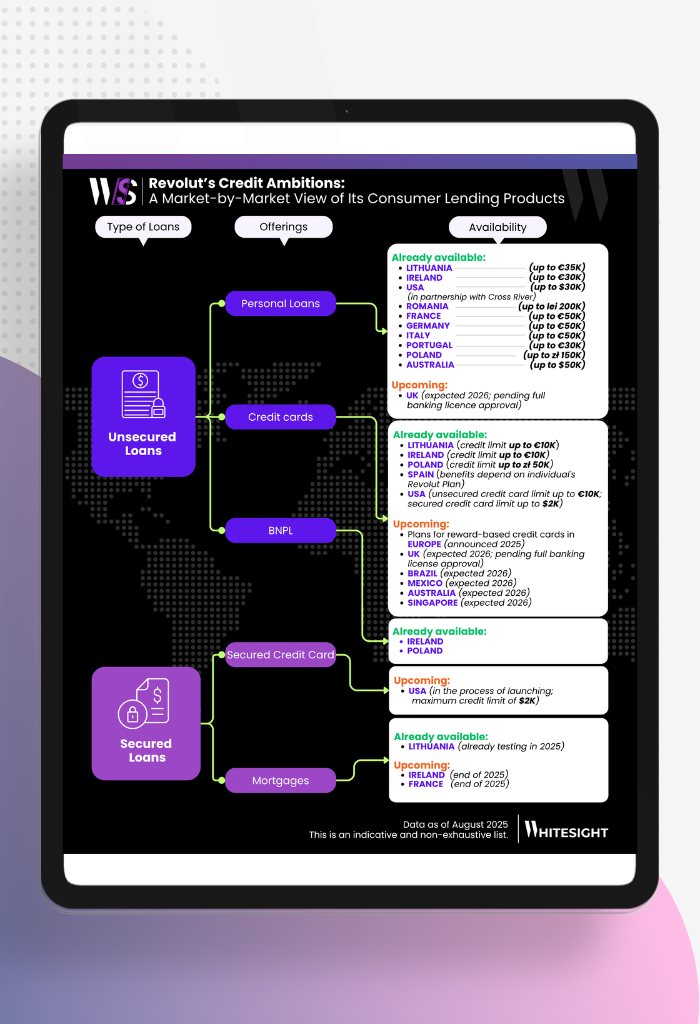

- Sanjeev Kumar and Risav Chakraborty

The Consumer Lending Opportunity Behind Revolut’s Global Ambition Consumer lending has always been the prize pool of banking. In Europe,...

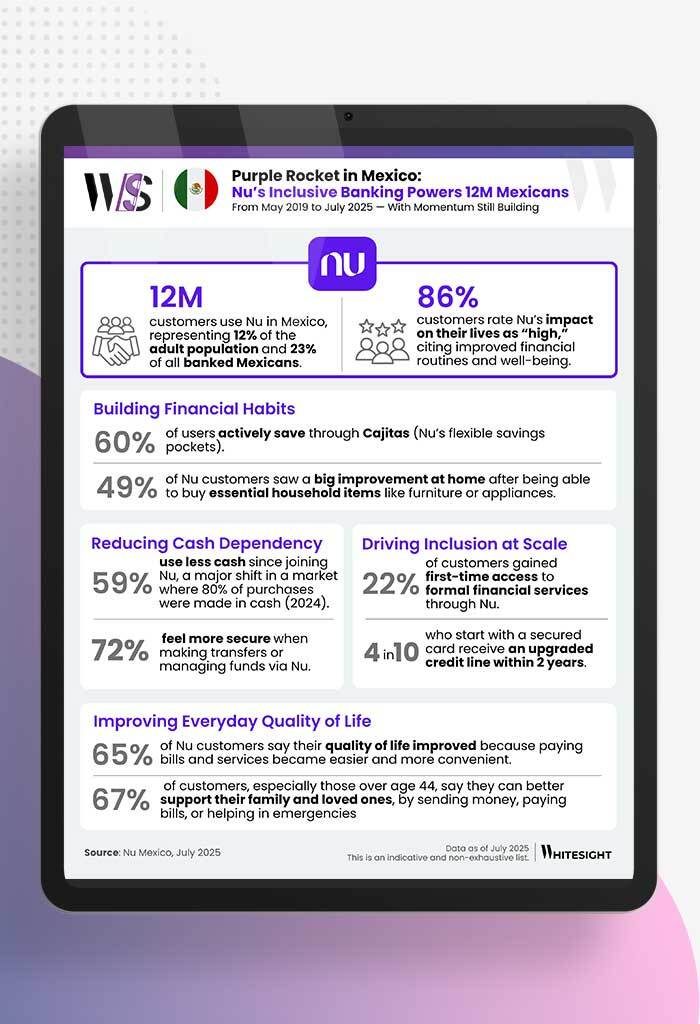

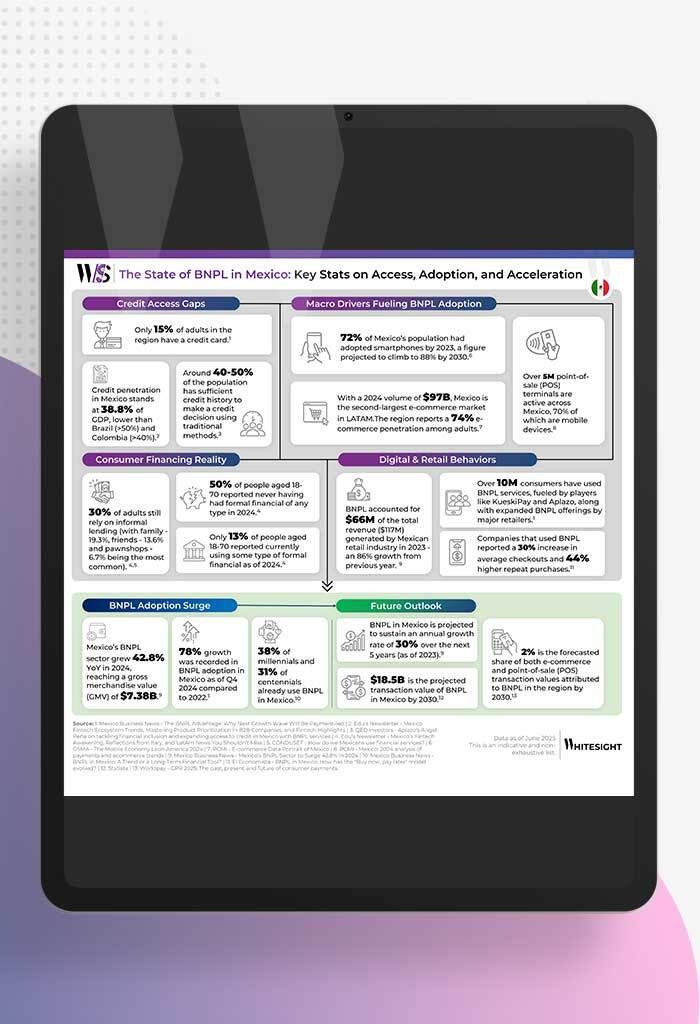

- Kshitija Kaur and Sanjeev Kumar

A Market Ripe for Reinvention With nearly 130 million people, Mexico is the 15th largest economy globally and the second...

- Kshitija Kaur and Sanjeev Kumar