The State of Green Finance | FinTech Roundup 2022

January 5, 2023

The State of Green Finance | FinTech Roundup 2022

If there’s one thing that can be agreed upon, it is that 2022 has been a year of many lessons. Natural disasters brought upon by climate change set the tone for what will become the new normal and emphasised the push for sustainable practices in all aspects of life and economies.

Complimentary Research

Description

In today’s economic and financial debates around the globe, the colour green reigns supreme ― green banks, green bonds, green investments, and green finance instruments are touted as driving clean growth, sustainability, and resilience. In the post-pandemic economy, investors and policy advisors reiterate the importance of considering environmental issues and climate change impacts when making financial decisions.

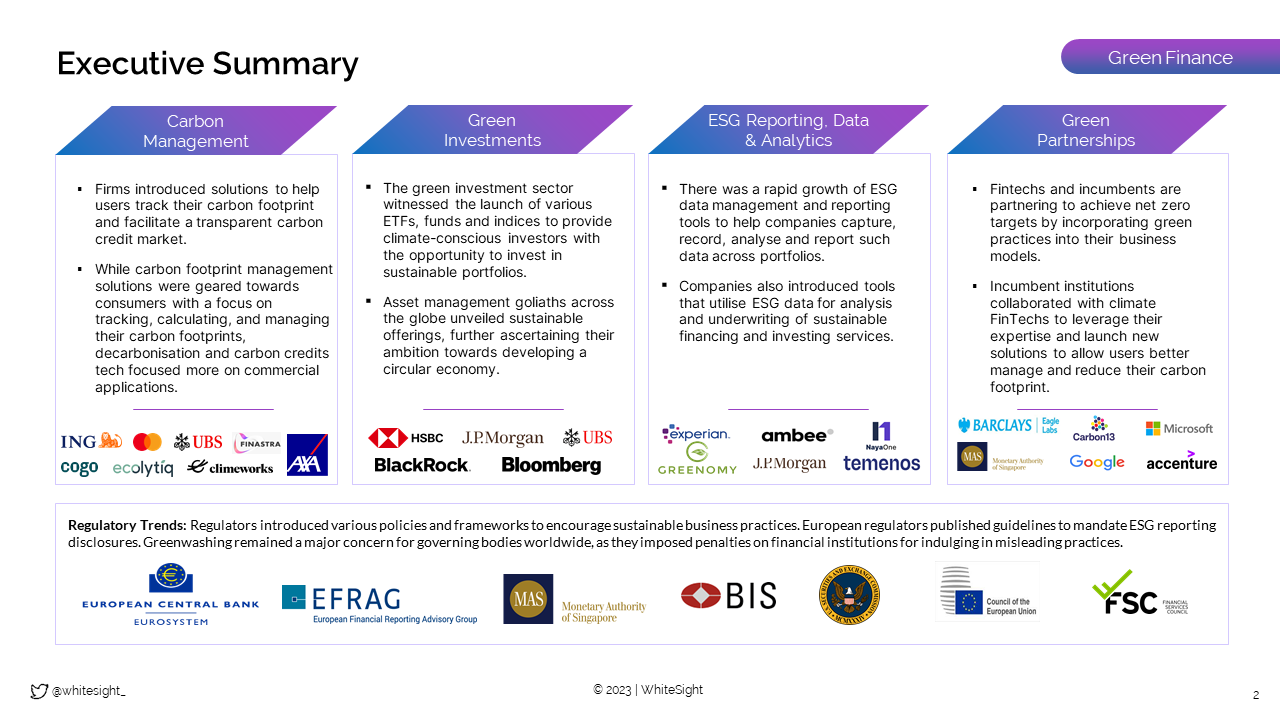

The sustainable finance space is constantly evolving, and recent trends saw an ever-hastening demand for capital to move in greener circles. The year saw a growing need to manage carbon emissions and decarbonise industrial sectors of the economy. On the other hand, many incumbent institutions collaborated with climate-centric companies to launch green products and services for consumers and businesses. With green investments and green financing also being top of mind for corporate heads worldwide, the green finance sector is on the path of strengthening connections to mobilise the transformation towards an inclusive, low-carbon and enabling economy.

To get an inside scoop on the journey of financial think tanks and institutions towards their transition to net zero, we’ve crafted a roundup report capturing the significant trends and activities in the Green Finance space in 2022. It includes:

- Use case-based summaries of market trends. Use cases covered include carbon management, green financing, ESG reporting, data & analytics, sustainable web3 and more.

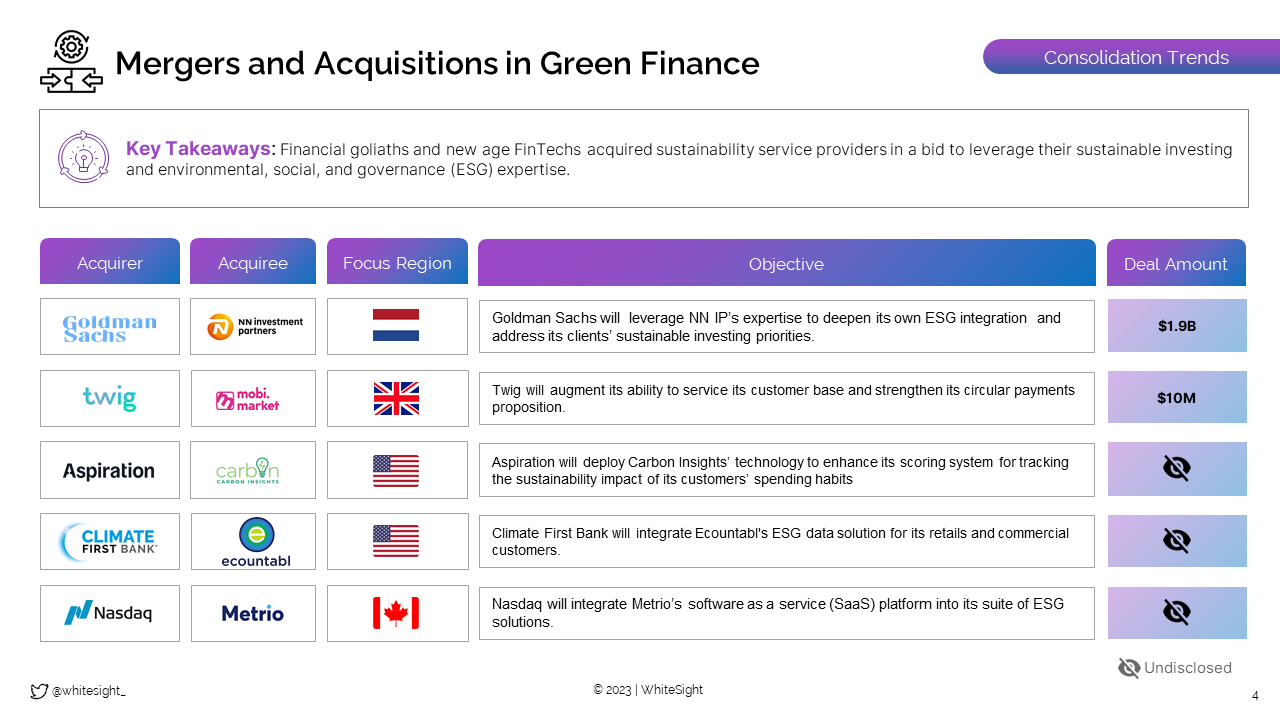

- List of notable funding rounds, mergers and acquisitions, and partnerships.

- Summary of global regulatory initiatives promoting green finance.

Already a subscriber? Log in to Access

Radar Subscription Plan

Radar Subscription PlanYour perfect fintech research companion – select a package that aligns with your aspiration

Not Ready to Subscribe?

Begin your fintech adventure free of charge-set forth with our complimentary offering.

Related Reports

Toast is revolutionising the restaurant sector by integrating financial services seamlessly into its restaurant management and Point of…

Dive into how Open Banking is shaking things up in the MENA region’s financial scene. It’s all about sparking collaboration…

Explore the journey of Starling Bank, a digital disruptor in the UK banking industry. With over 3.6 million…

Stripe is leading the fintech revolution, empowering a diverse range of businesses globally. Discover the tactics fueling Stripe’s…

Explore Revolut’s extraordinary growth, its journey towards obtaining a banking licence in the UK, the challenges encountered, and…

WhiteSight delves into the dynamic world of digital finance, bringing you an update from January to April 2023. We examine…

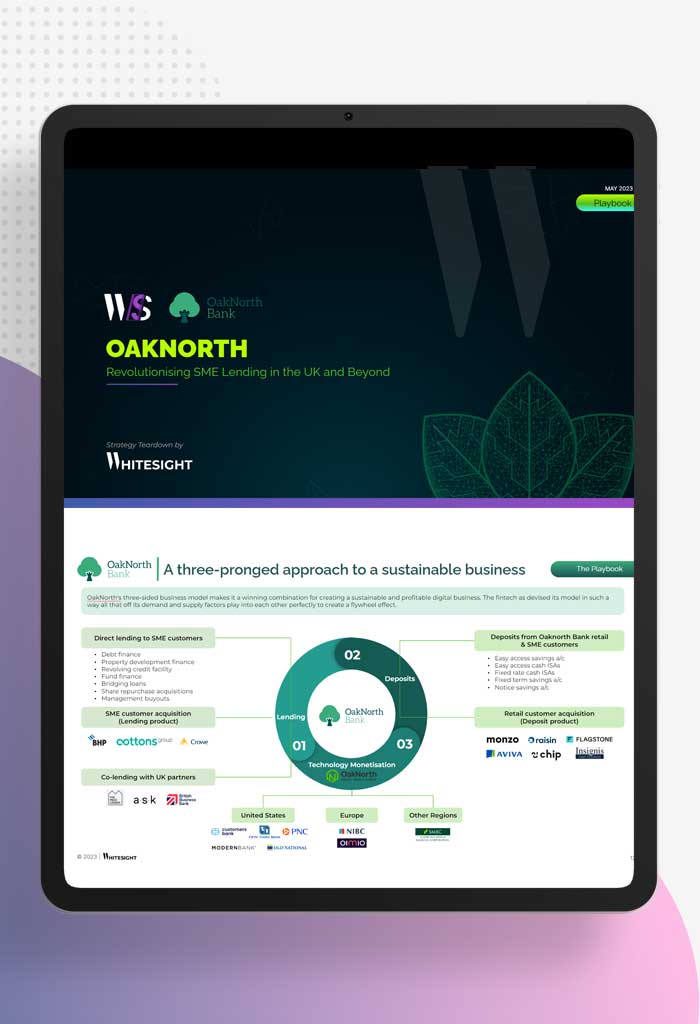

Explore OakNorth’s blueprint for building a tech-first bank that caters to the SME powerhouses of the UK. The…

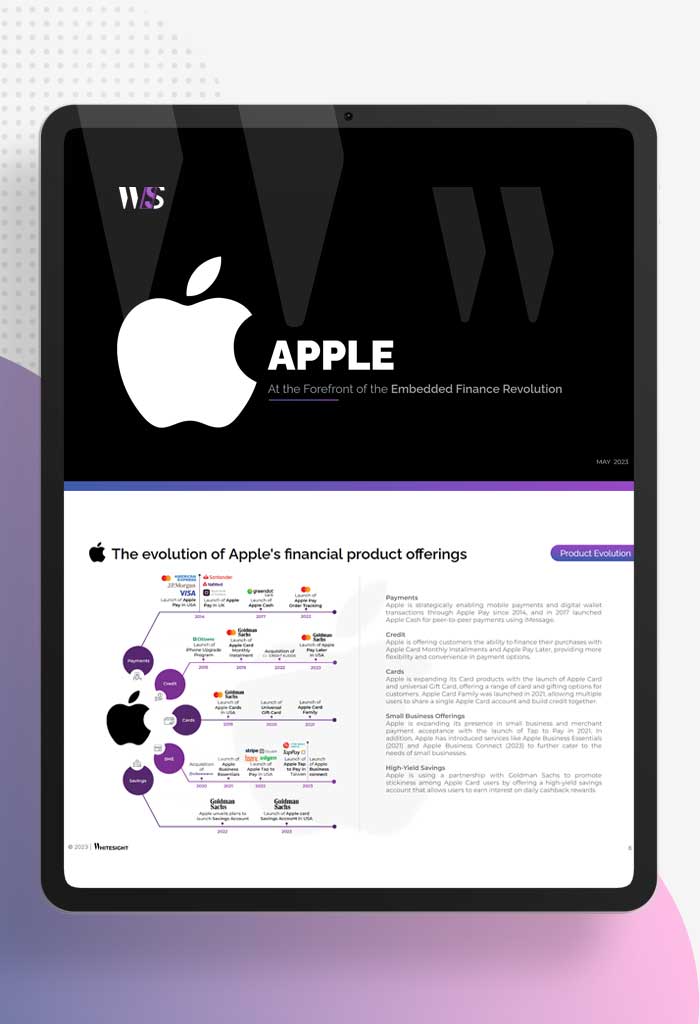

Since the inception of Apple Pay in 2014, Apple has been at the forefront of bigtechs exploring the…

WhiteSight joins forces with Toqio to delve into the heart of the Banking-as-a-Service (BaaS) market in the UK and Europe,…

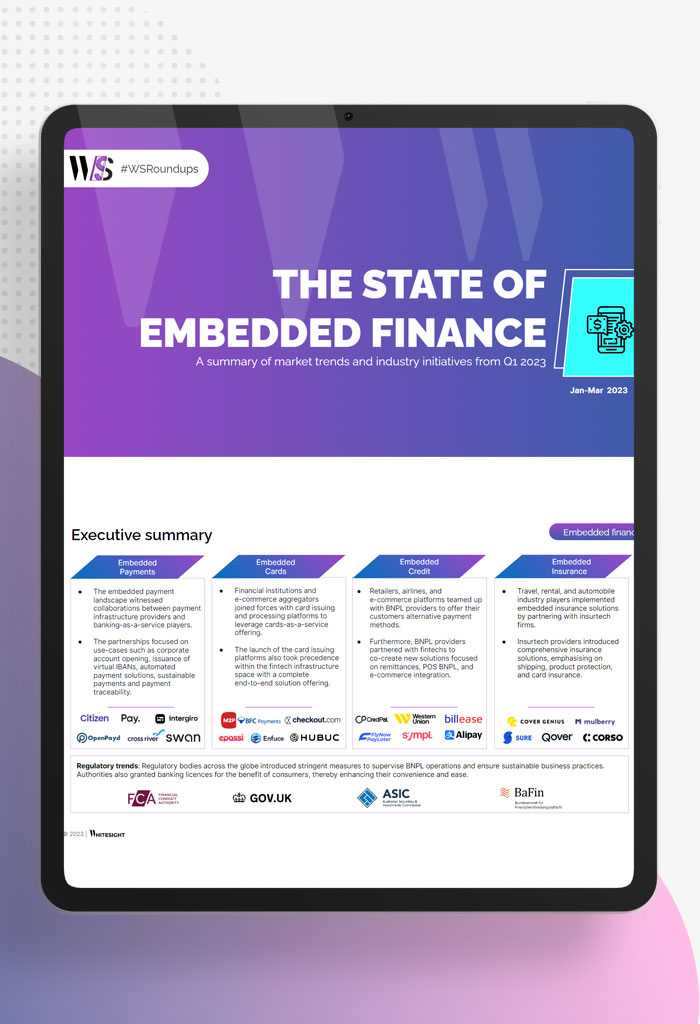

Embedded finance is experiencing an unprecedented surge in availability across multiple consumer touchpoints, enabling businesses to offer enhanced customer experiences…

With the world rapidly evolving and adopting new trends along the way, customers demand innovative products like never before, while…

The financial industry started the new year with the groundbreaking approach of open finance – an innovative paradigm that has…