The State of Open Finance

+

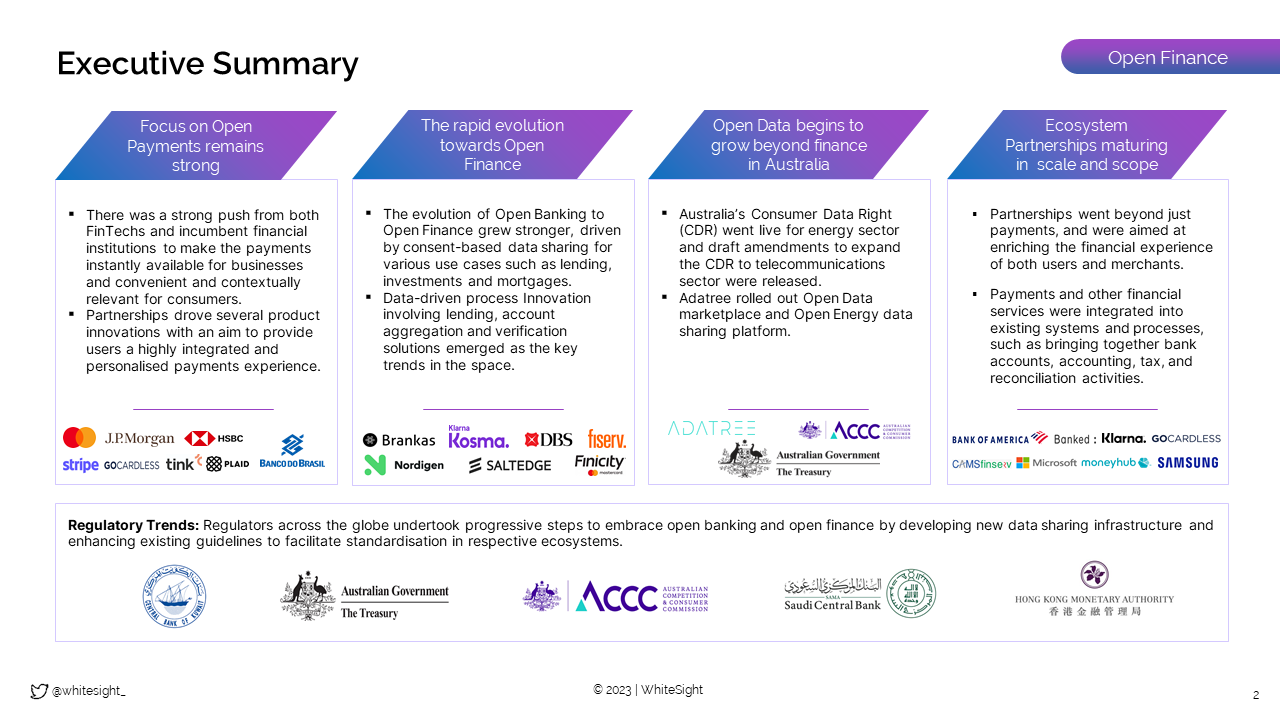

In 2022, the open finance space was flourishing with innovation and witnessed increased user adoption as people started realising the benefits and efficiencies of open ecosystems. This year was marked by a focus on improving payments through personalization and data-driven solutions, as well as the expansion of open banking to broader data syncing between financial institutions.

There were also collaborations between companies to offer enhanced financial experiences, and regulatory trends in regions such as the Middle East and Australia to facilitate the adoption of open banking and open finance. Overall, the open finance industry continued to grow and disrupt the traditional financial sector, with a focus on data transparency and innovation.

‘The State of Open Finance’, in partnership with Open Future World, provides a summary of the notable events across various categories, including:

- Use case-based summaries of market trends. Use cases covered include digital payments, digital lending, personal finance management and customer onboarding.

- Notable product launches and innovation using Open Data.

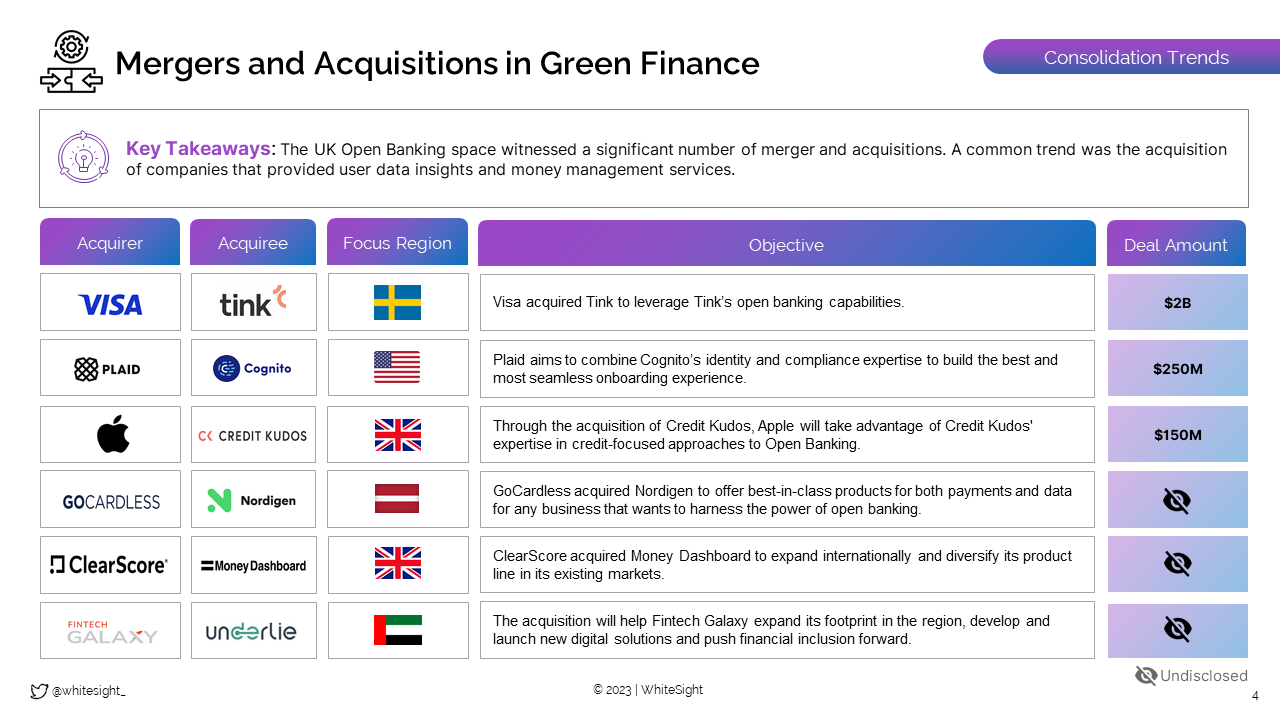

- List of notable funding rounds, mergers and acquisitions, and partnerships.

- Summary of global regulatory initiatives advocating open economies.