A Brief History of Time – 2021 FinTech Public Listing Trends

- Sanjeev Kumar and Kshitija Kaur

- 4 mins read

- Fintech Strategy, Insights

Table of Contents

2021 emerged as a groundbreaking year for FinTechs. Much more money poured in. Several fintechs exited by getting acquired by incumbents or by scale-up fintechs. But arguably the most important trend of 2021 was a blizzard of fintechs choosing to list on public markets. Fintechs’ product and geographic expansion plans coupled with venture capitalists’ search for returns incentivized the choice of public listings.And while some did achieve this milestone with great response in public markets, others struggled to maintain their listing valuations and witnessed moderate to massive corrections in their share prices, a subject that we implored in-depth previously through the 2021 FinTech Public Listing Trends. FinTechs’ Battle For Sustainable ProfitsOut of the 21 FinTechs that went live on public markets in 2021, only 6 made the cut in having their books in green. UK-based money transfer fintech Wise, which listed on the London Stock Exchange in the month of July with a valuation of $11bn, witnessed a rise of 9% in shares during the early trade itself. It is one of the rare fintechs, which has been profitable for over 4 years before listing.Crypto-lending and exchange platform Coinbase also makes its mark as a young growth company that has […]

This post is only available to members.

Already a subscriber? Log in to Access

Unlock this blog

Gain exclusive access to this blog alone.

Radar Subscription

Select a membership plan that resonates with your

goals and aspirations.

Not Ready to Subscribe?

Experience a taste of our expert research with a complimentary guest account.

We publish new research regularly. Subscribe to stay updated.

No spam.

Only the best in class fintech analysis.

Related Posts

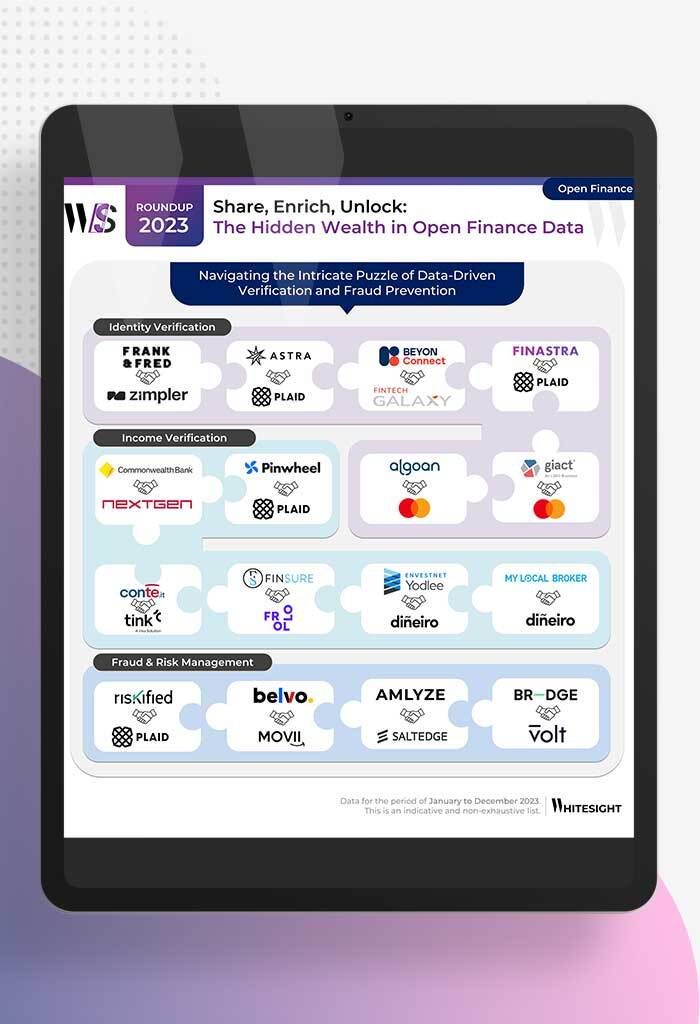

- Kshitija Kaur and Sanjeev Kumar

From Data Streams to Enriched Data Fountains Remember the early days of plumbing? Water flowed freely, but its quality was...

- Samridhi Singh and Sanjeev Kumar

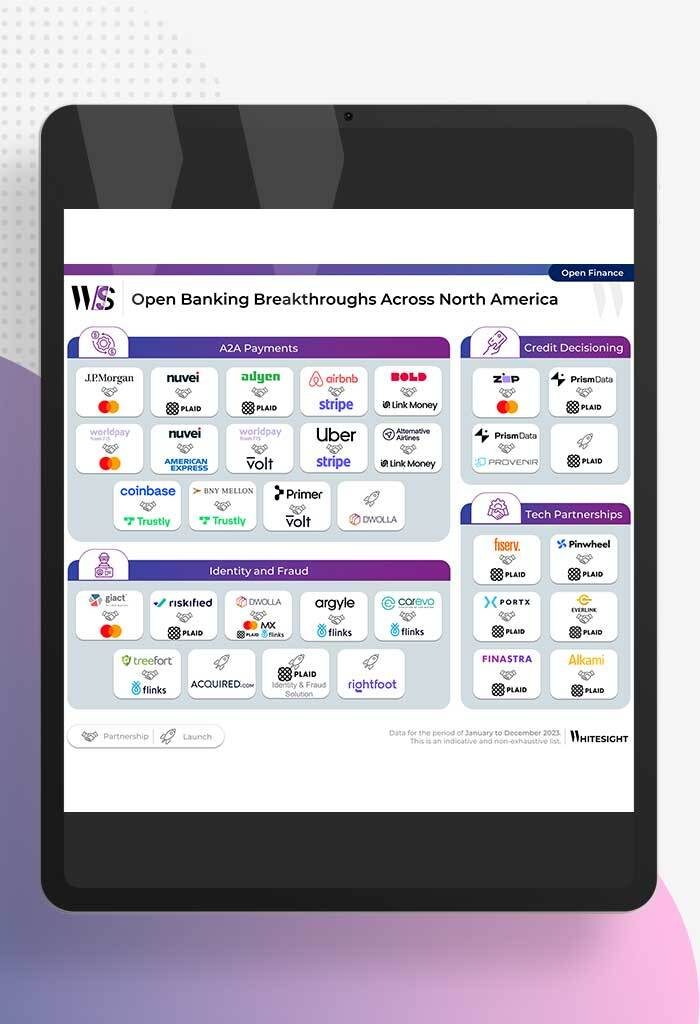

North America’s Open Sesame: Use Cases Bloom Open banking has garnered significant attention in recent years, and at Whitesight, we’ve...

- Samridhi Singh and Sanjeev Kumar

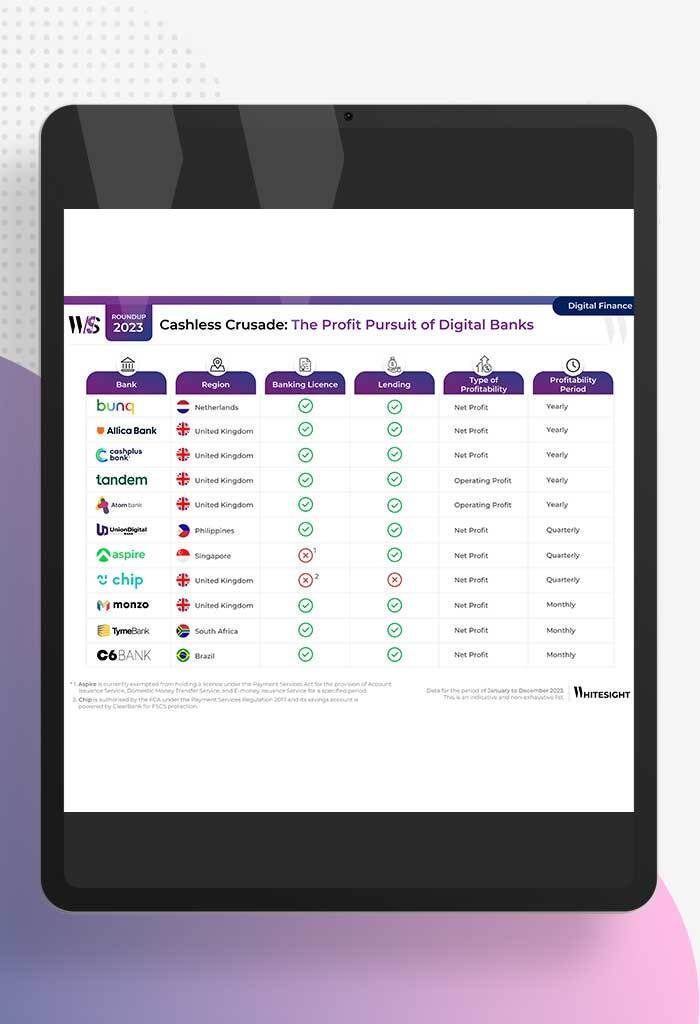

Profitability Unlocked: Licences, Service, and Survival The rise of digital banks has sparked a paradigm shift in how we perceive...

- Sanjeev Kumar and Risav Chakraborty

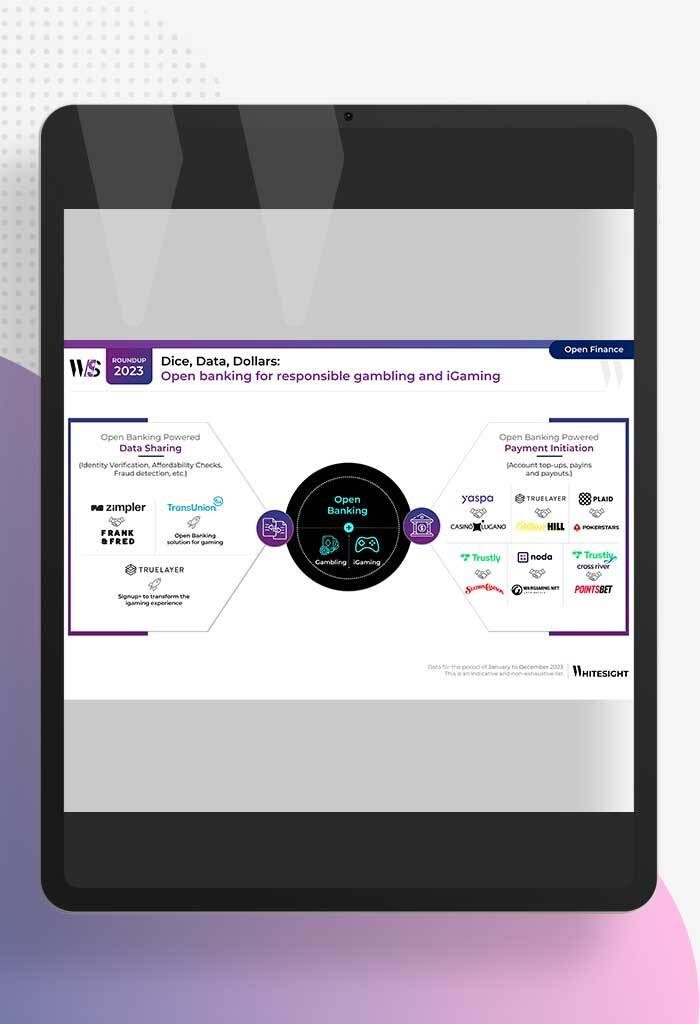

High stakes in the gambling sector The online gambling industry is booming, with a projected market size of $107.3B by...

- Sanjeev Kumar and Risav Chakraborty

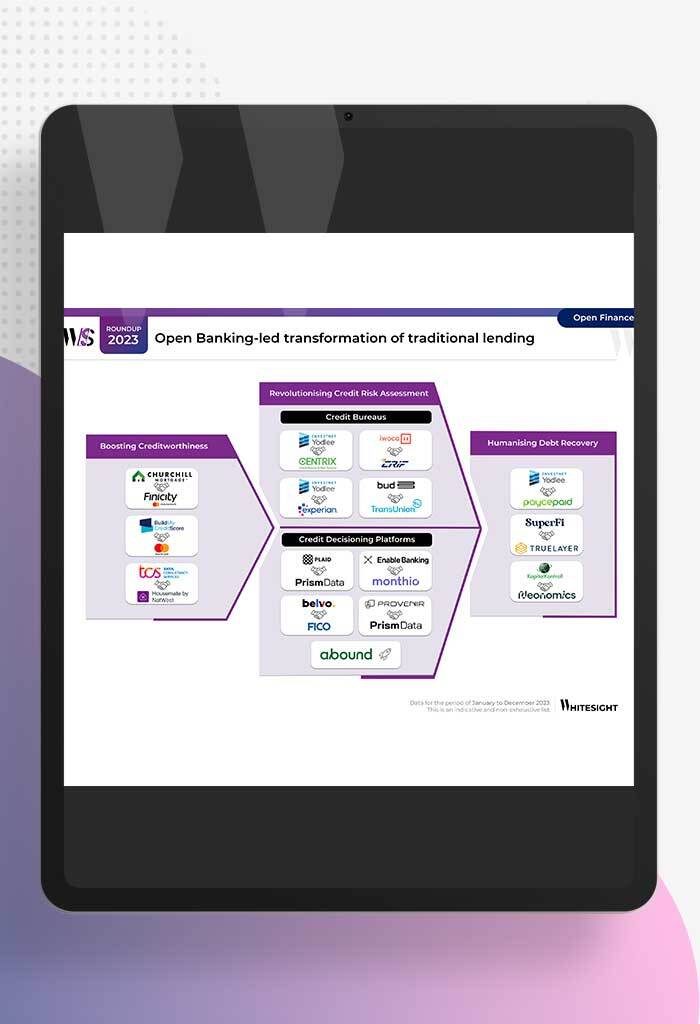

Open Banking-led Transformation of Traditional Lending In 2023, a wave of innovation swept through the lending industry, thanks to several...

- Sanjeev Kumar

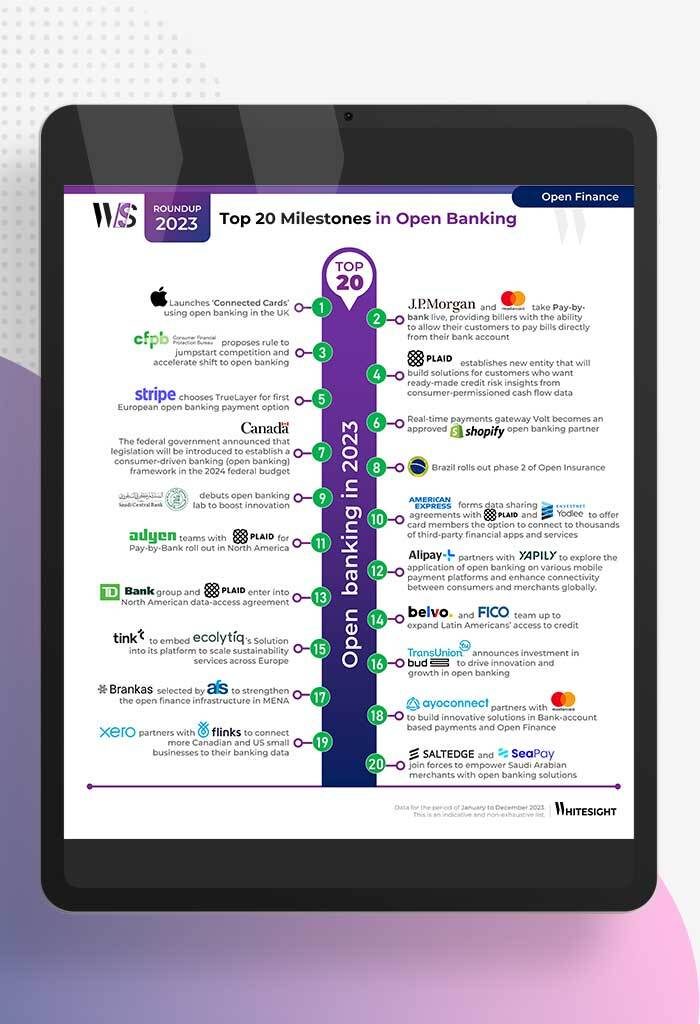

Unmasking Open Banking’s Game Changers in 2023 2023 has been a pivotal year in the world of open banking, marked...